Wallstreet new Records and more

The S&P 500 Index reached a new all-time high on Friday, capping off a global stock rally that also lifted European and US futures. The Stoxx 600 index in Europe rose 0.8% on Monday morning, driven by gains in banking, real estate and tech sectors. Tech stocks also boosted US futures, as investors anticipated lower interest rates from the Federal Reserve and a surge in artificial intelligence. However, Chinese stocks lagged behind, as the country’s economic recovery showed signs of weakness.

The S&P 500 has rebounded strongly from its low point in October 2022, increasing by about 35% and breaking its previous record of 4,796.56 on Friday. It was the last of the three main US stock indexes to achieve this feat.

Jun Bei Liu, a fund manager at Tribeca Investment Partners in Sydney, said: “We are entering a situation where the economic slowdown is more mild, and we are also expecting rate cuts. This combination is very favorable for the stock market.”

The online gambling industry in Europe will become more concentrated after La Francaise des Jeux SA proposed to acquire the Swedish firm Kindred Group Plc for 27.95 billion kronor ($2.7 billion), sending its shares up 19% on Monday. The dollar and US Treasuries were stable. Benchmark notes rose on Friday as a survey from the University of Michigan indicated high consumer confidence and low inflation expectations, which is favorable for the Federal Reserve.

Later this week, investors will focus on the Bank of Japan, which is expected to keep its policy unchanged on Tuesday when it reveals the outcome of its meeting. On Thursday, the US will release its preliminary estimate of fourth-quarter GDP and the European Central Bank will make its rates decision.

On Monday, Asian stocks gave up their earlier gains as the Hang Seng Index plunged 3% and the main indexes in China also declined. China’s commercial banks maintained their benchmark lending rates on Monday, following the central bank’s choice last week to avoid lowering interest rates.

Vasu Menon, investment strategy managing director at Oversea-Chinese Banking Corp. in Singapore, said that the current cheap prices of Chinese stocks are not enough to attract investors back to the markets. He said that he thinks that Chinese policymakers will offer more stimulus, but he wonders if it will be big enough to satisfy the markets.

Oil prices dropped as Libya, an OPEC member, resumed production at its biggest field, increasing global supplies and temporarily easing worries about the Red Sea tensions that are likely to keep affecting shipping.

Metal market forecast

According to our projections, the global tin market will be in equilibrium in 2024. Our model estimates that the average LME cash price will be about $27,040 per tonne, which is a 4% increase from 2023. We expect tin to bounce back in 2024 after a difficult 2023, which witnessed a 17% drop in prices compared to 2022 based on yearly averages.On the supply and demand side, we observe a shrinking of the refined market, fueled by higher semiconductor sales and the effect of the mining prohibition in Myanmar.

We expect the global market balances for the other four base metals to be in excess supply in 2024. However, the anticipated surplus in aluminium is negligible at 0.4% of total demand, which should boost the prices this year. Our current prediction is that the LME cash price will average at $2,212 per tonne in 2024, 1.6% less than the previous year’s average.Aluminium demand growth is likely to increase to 2.8% from 0.9% in 2023, while primary production is projected to grow at a similar rate, speeding up from last year’s 1.3%. We foresee Chinese production to reach 42.2 million tonnes in 2024, up 2.2%, with maximum operational capacity reaching around 45 million tonnes per year – the highest level of the government’s capacity limit. Production for the rest of the world will rise by 3.8%, reversing the drops of the past two years.

We anticipate the global refined lead market to shift from a slight supply excess in 2023 to a larger surplus this year equivalent to 0.9% of yearly demand. This is likely to result from increased Chinese production and thus the possibility of higher export volumes to markets outside China. This is a key context that should put lead prices under strain around the crucial $2,000-per-tonne level, before rebounding in 2025, when the market is expected to move back into a supply shortage.

We predict an annual average lead price of $2,022 per tonne, which is 5.4% lower than the 2023 average, but still around the center of a wide sideways trading range that has lasted for over a decade.

Zinc, the related metal of lead, is in a poorer fundamental condition with a refined market excess supply equivalent to 2.6% of demand this year, although we have recently lowered this estimate due to production reductions, mining company outlook downgrades and project postponements. The threat to this scenario is that the market becomes tighter because of more supply changes, which would boost prices.

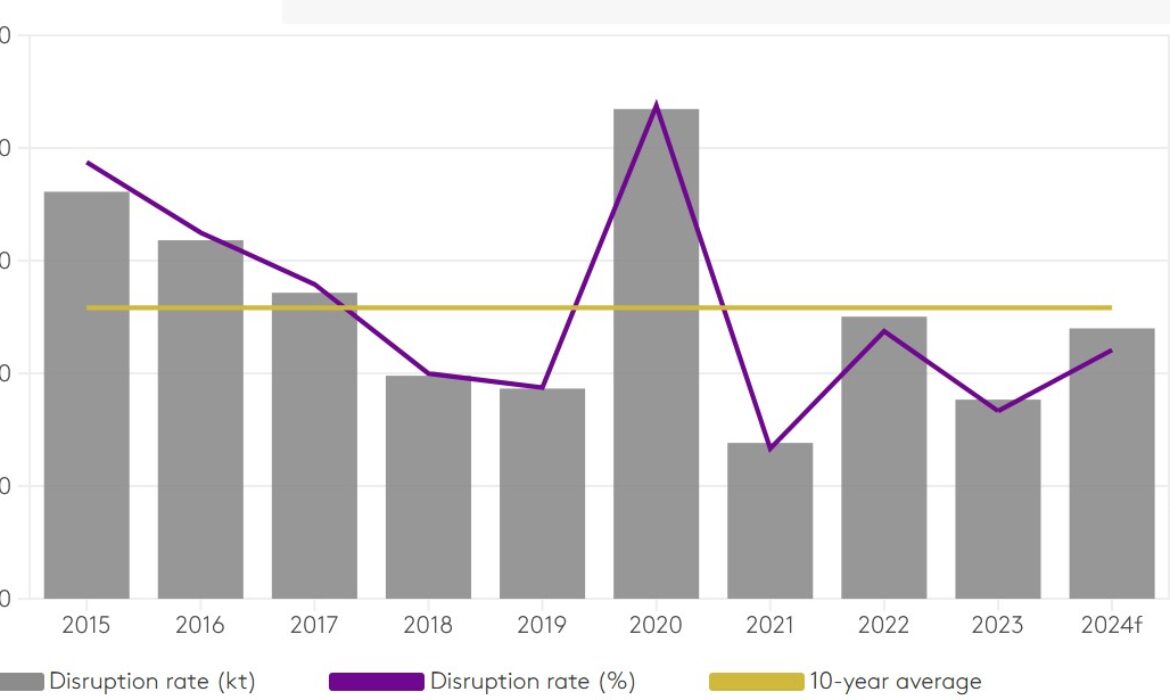

We will modify our predictions for prices, premiums and treatment charges accordingly in the next few months if those events surpass our current disruption allowances. As of now, the LME zinc price is expected to average $2,471 per tonne, about 6.5% lower than the 2023 average. Any positive potential in the short term is likely to be restricted to bear market recoveries, with robustness forecast for the latter half of the year dependent on Chinese authorities effectively handling the property market crisis and controlling contagion risks, which remain our main case view.